Base Metals - Aluminum - Copper - Nickel

Base metals see mixed month ahead as China optimism coolsBase metals futures on the London Metal Exchange showed little sign of any change as sentiment for a rebound in Chinese demand was dampened as potential Chinese stimulus failed to materialize in June

Base metal prices were flat for most of June as the market grew more impatient with China's stimulus package, the West Asia Import-Export Group understands. However, as China's economic recovery begins to accelerate, the metals industry driven by China's economy may see gradual stabilization in the second half of the year.

New headwinds in aluminum market

Aluminum

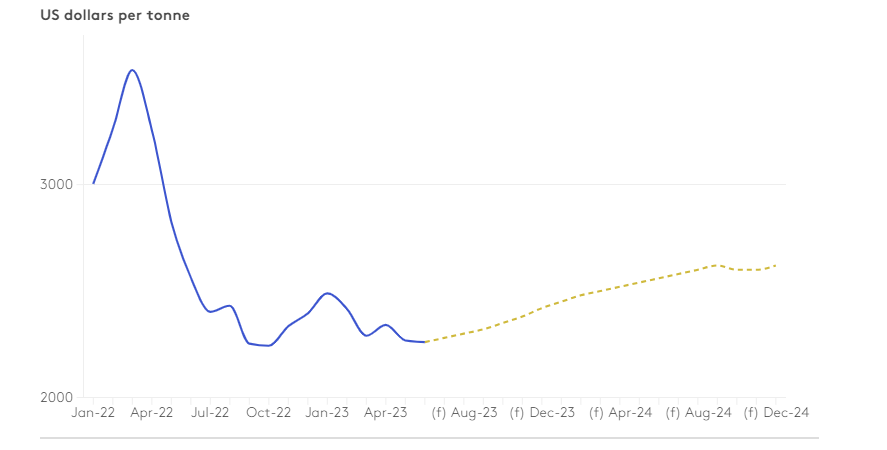

Aluminum prices on the London Metal Exchange face fresh headwinds as it is understood that smelting operations in China's Yunnan province are about to resume. Most of the previously cut aluminum smelting capacity in Yunnan resumed production on June 20. With the increase in power supply, the annual increase in aluminum smelting capacity is as high as 1.3 million tons.

Despite our positive view on aluminum prices in the short term, we remain cautious that aluminum prices could be more volatile in the medium term. We reiterate that the general downtrend that began with the sell-off high in March 2022 is likely to continue for now. A positive break above the January 2023 high would be needed to change this view.

The imminent resumption of previously suspended smelting capacity in China's Yunnan Province on the back of improved energy supply is a fundamental headwind supporting our downside view. learn more.

Copper prices will recover before the end of this year

Copper

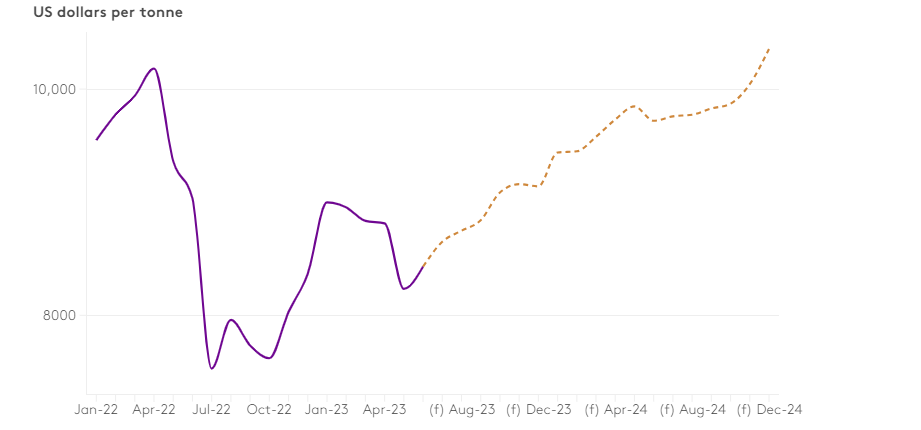

The recent rise in copper prices, largely due to increased economic support from China, was driven by short-covering rather than new buying, suggesting cautious sentiment. Official LME copper prices rose 2.3% in the week to June 16, their third straight weekly gain. That same week, China's state planners acted proactively, rolling out tax incentives and providing additional credit opportunities for small businesses. These measures are aimed at addressing pressing issues affecting consumers and investors, while attempting to increase liquidity in the financial sector and address economic challenges.

Traditional seasonal trends point to possible price weakness ahead. However, we expect copper prices to rebound strongly in the second half of the year as China's economic recovery accelerates. Therefore, any imminent price decline should not be viewed as a sign of concern, but rather as a window of opportunity to increase exposure to the red metal.

Nickel price bear market rebound?

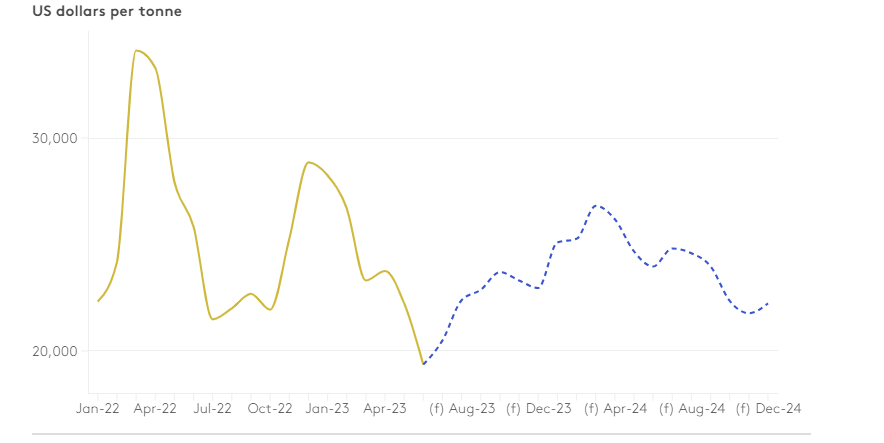

LME nickel spot prices rose by an average of 4.9% on a weekly basis and 5.0% in three months in June, making nickel the strongest performer in the base metals group.

Nickel

While nickel prices have rebounded nicely and could still move higher in the short-term, we think it is prudent to view this as a bear market rally. It can produce lower highs and a long-term downtrend. Before long, the bears may refocus on the $20,000 a tonne level and 2022 lows. While we may not yet see the lowest levels in 2023, we still see an uptick and upward trajectory for nickel prices in the fourth quarter.

China's medium-term stimulus to boost prices?

Base metals prices remained mixed amid uncertainty over China's stimulus measures. Markets appear to be skeptical of China as policymakers did not do enough to support the economic recovery in the first half of the year.

Chinese policymakers are now showing a willingness to provide more support to the economy. With a series of tax breaks and proposals for more loans for small businesses, China's state planners are negotiating a solution to problems already felt by many consumers and investors.

We expect China's economic recovery to accelerate in the second half of the year, which will logically support base metal prices. learn more.

Base Metals Price Outlook

In the most recent CFTC Commitment of Traders Report (COTR), we observed another reduction in bearish speculative positioning in CME copper to the smallest net short position since mid-April. This decline compares with the largest net short position observed since the height of the Covid-19 panic in March 2020.

The reduction in the net-short position was accompanied by a recovery in copper prices as long position holders increased their bullish exposure and short position holders reduced their bearish exposure. We have seen similar developments in LME data covering other base metals, with short covering and long position building leading to higher prices.

Investors may take a less pessimistic stance as the U.S. debt ceiling impasse is resolved. The U.S. dollar index traded lower as the Federal Reserve paused in rate hikes and Chinese policymakers are supporting the country's housing sector and broader economic recovery.

Further positive changes in macro sentiment could lead to more short covering and/or long position building, which would drive base metal prices higher in the medium term. learn more.

To understand the complex market conditions that affect price fluctuations, please contact us. West Asia Import and Export will bring you the basic metal price forecast, market outlook, and provide you with quotation services.

If you're interested in our products or have any questions,please don't hesitate to contact us!

JP

JP KR

KR CN

CN RU

RU